About ID Document and Biometric Verification

Digital onboarding offers challenges that face to face onboarding does not. Companies need to remotely ensure who their customer is and detect potential risks for diminishing the chance of being used for illegal activities.

The ID Document and Biometric Verification product drastically simplifies the onboarding process in many industries like banking and finance. With this product, you can perform online identity verification of your prospective customers by scanning and checking their ID documents and/or do biometric checks via video calls. All this is accessible through the Signicat Assure API as one single point of integration.

The Assure API allows you to integrate with different electronic Identity Document Verification (eIDVs) services, for example Onfido, ReadID and Electronic IDentification. When choosing which identification service to use for identity verification, you must consider multiple factors such as the required level of assurance, user experience, the nationality of end-users, etc. This is typically dictated by the geographic markets that your company operates in and is often subject to local regulatory requirements.

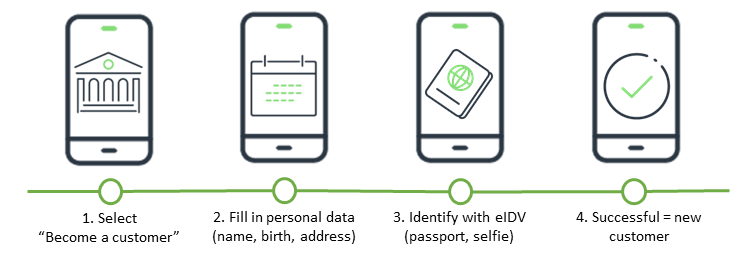

Use case example: Onboarding a new customer

Picture a potential customer, let's call her Claire, who wants to open a new online bank account. The bank might want to take several different steps to ensure that it is indeed Claire who is opening this account. The following is just one of many possible workflows.

End-user perspective

- Claire enters the bank's online website and selects “Become a customer”.

- The bank asks Claire to provide some basic information about herself, such as her full name, date of birth and address.

- The bank asks Claire to identify herself using her passport and take a selfie.

- The identity verification is finished and Claire can continue as a new customer of the bank.

Process options

Bank's perspective

- A new user, Claire, wants to become a customer in the bank.

- The bank initially collects information from Claire in a form on the website, among the information her full name, date of birth and address.

- Based on the type of customer relationship, risk profile and regulatory requirements the bank decides on the necessary steps in the customer due diligence process.

- Now the bank calls Assure API to create a dossier, which is a container for all information needed to perform the identity verification.

- The bank submits relevant information about Claire as user data to Claire's dossier in the Assure API.

- The bank asks Claire to use her passport to further prove her identity. The bank creates a process using one of the available eIDV services. The result of the method returns the information from the identity document and the result of the face match and liveness detection to Claire's dossier.

- The necessary identity information is used to establish an identity in the bank's identity store and the relevant proof is extracted from the Assure API. The bank then sends a delete request to permanently delete all of Claire's PII data from Signicat's platform.

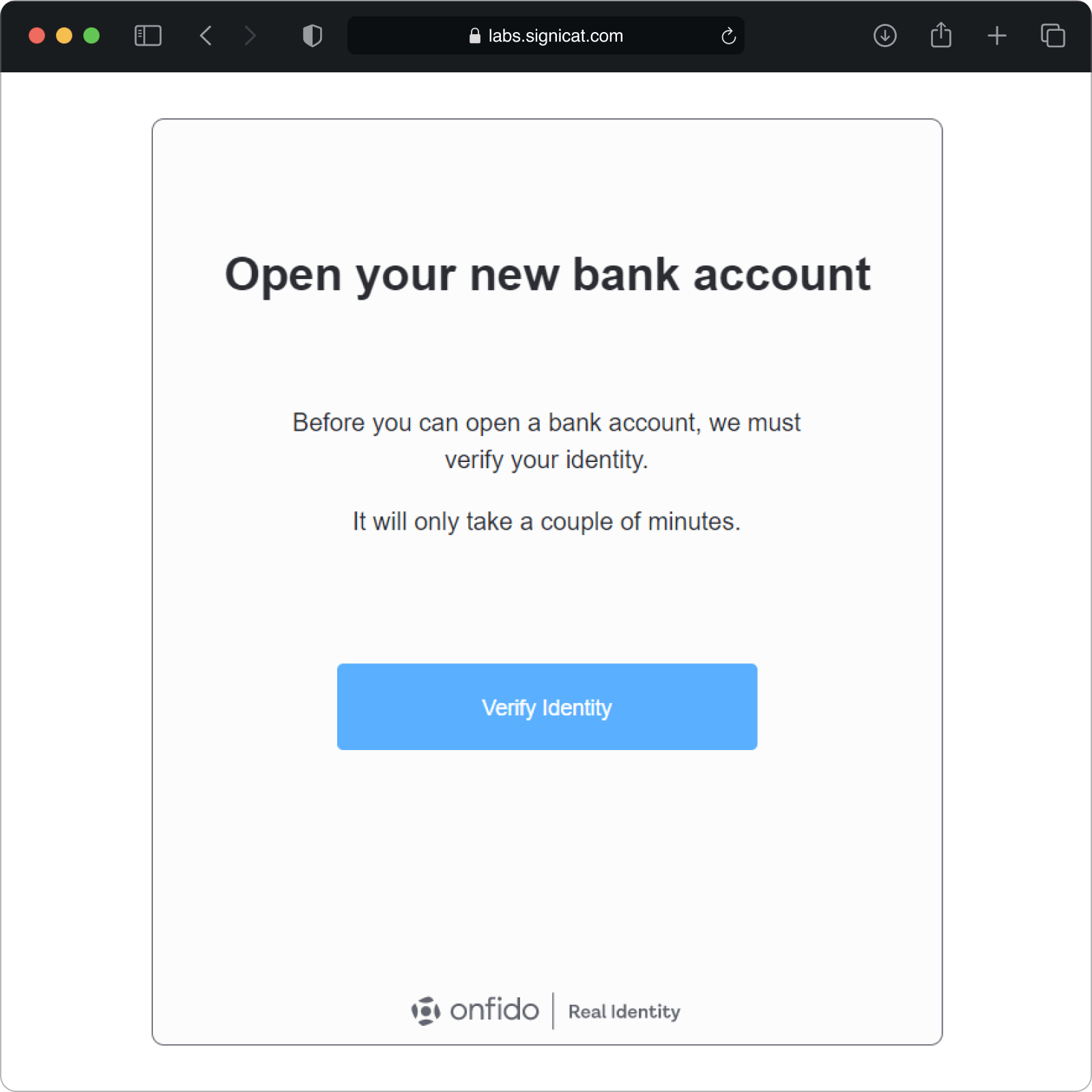

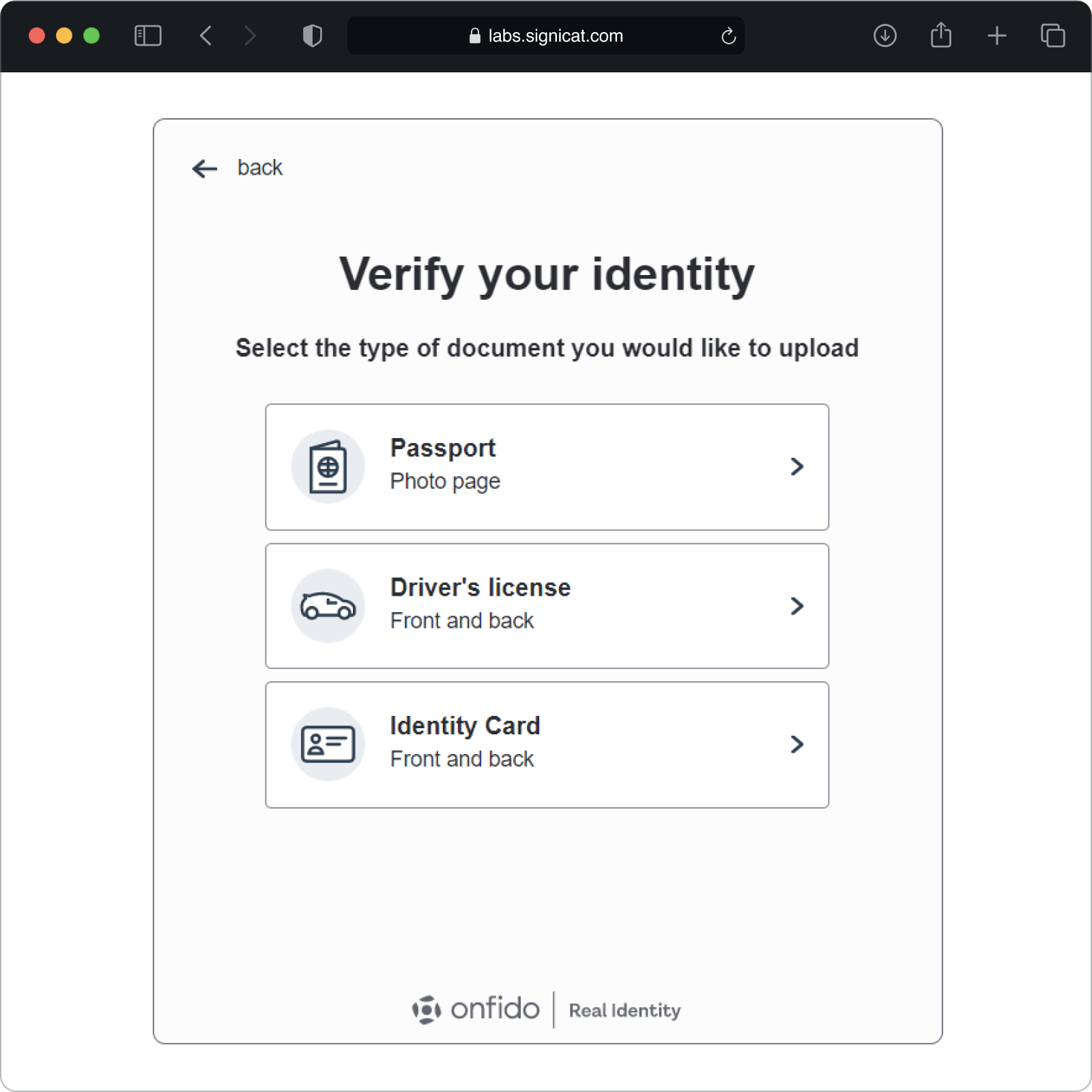

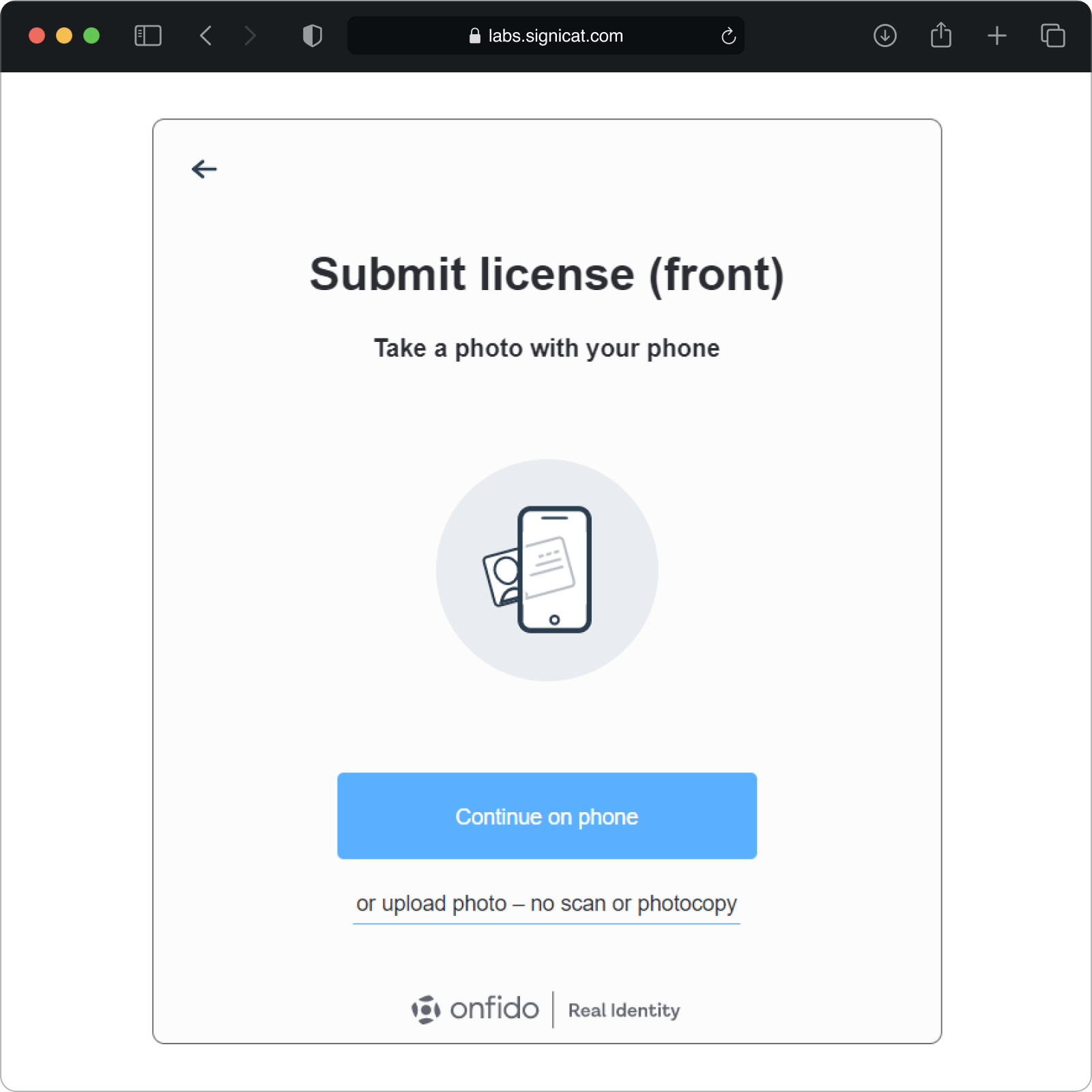

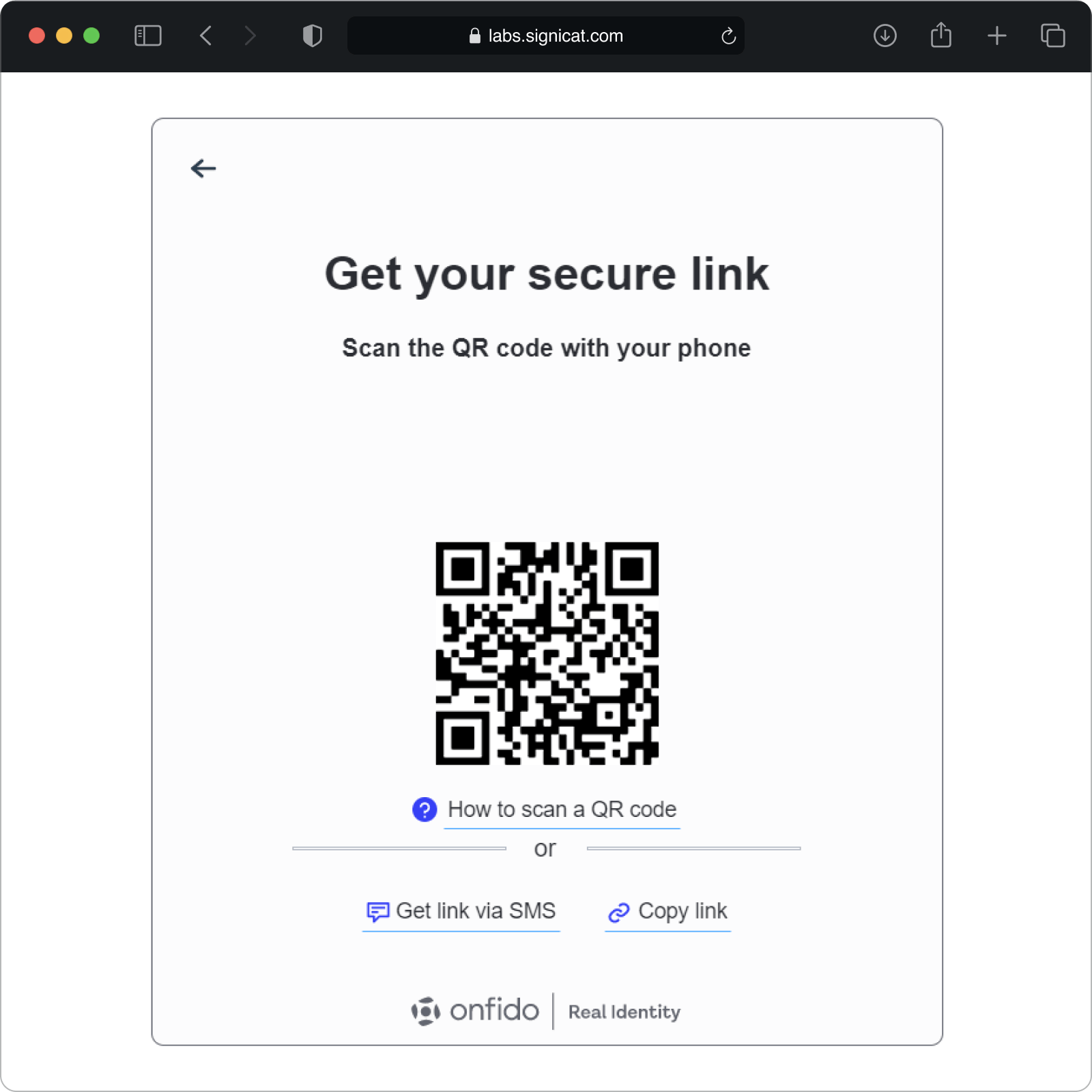

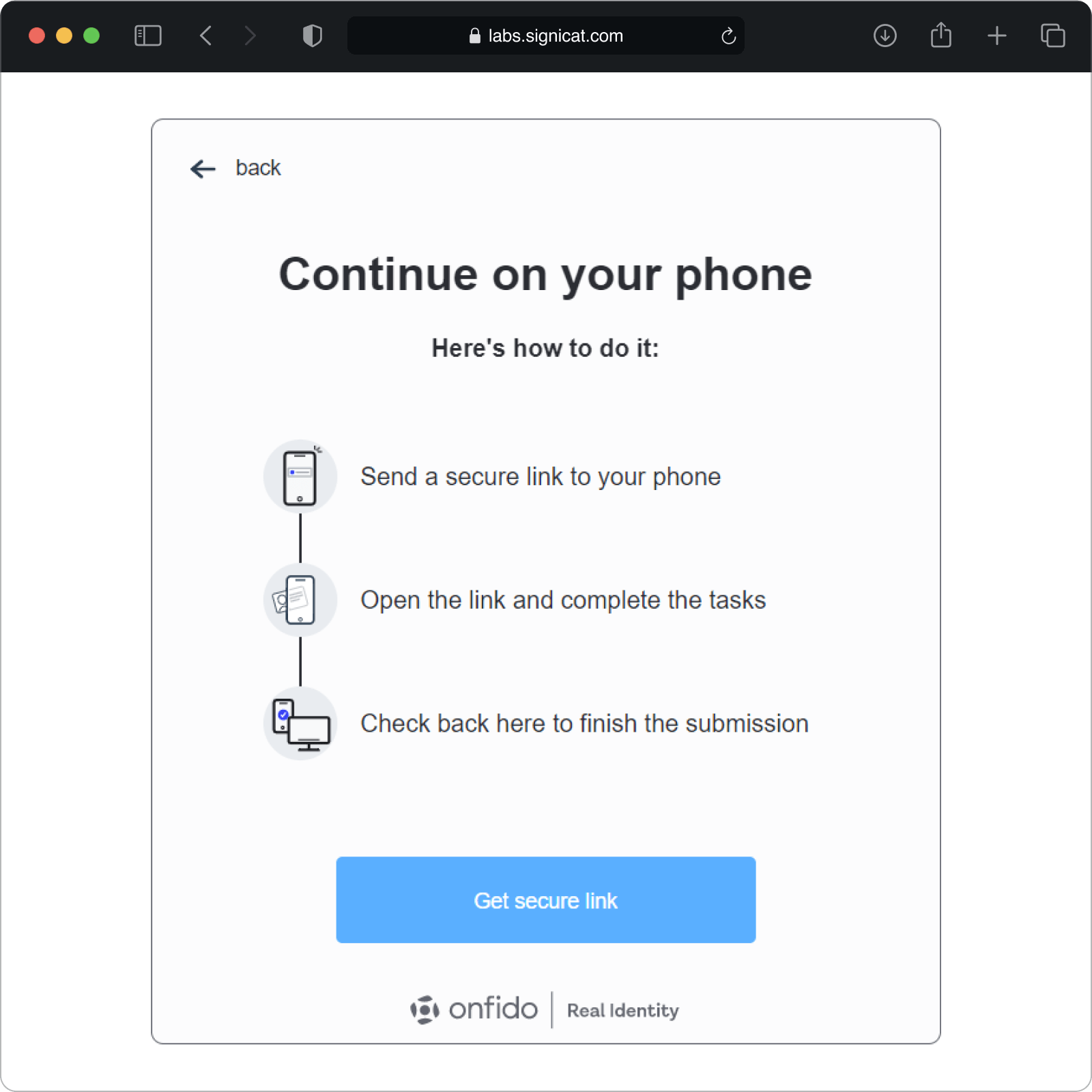

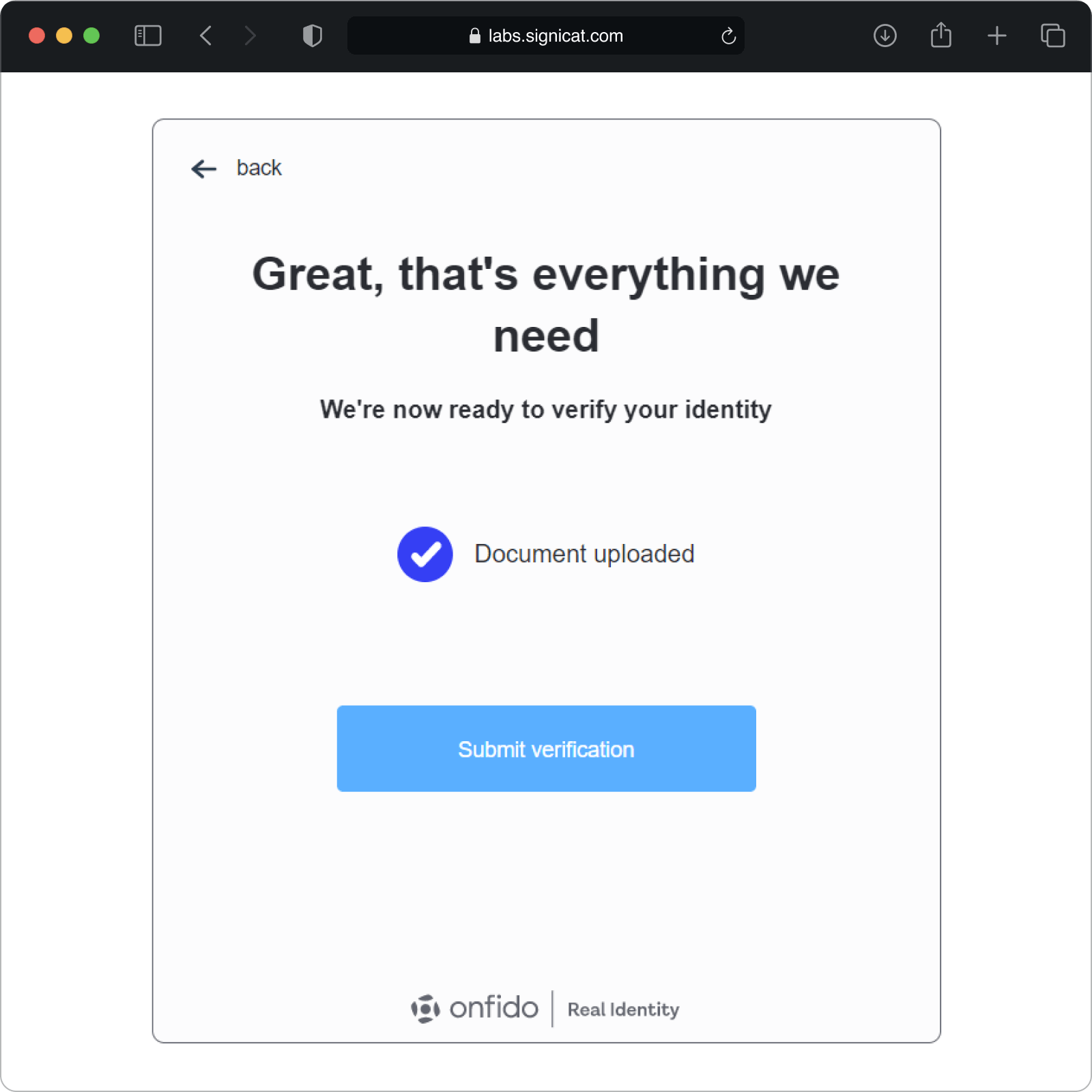

User flow example

Before you start the integration with Assure API, it is useful to know how the identity verification works from the end-user perspective. The following example shows the identity verification flow from Onfido's native SDK. Basically, the end-user is asked to take a photo of their ID document and a selfie to match those images.